Find Out 17+ Facts Of Accrued Revenue Examples People Forgot to Share You.

Accrued Revenue Examples | Your company lent a supplier $100,000 on december 1. Accrued expenses broken down | adjusting entries. Accrued revenue consists of income that has been earned from customers but no payment has been received. In january, it performed 7,000 hours of consulting, generating $700,000 of revenue. The accrued revenue is a current asset.

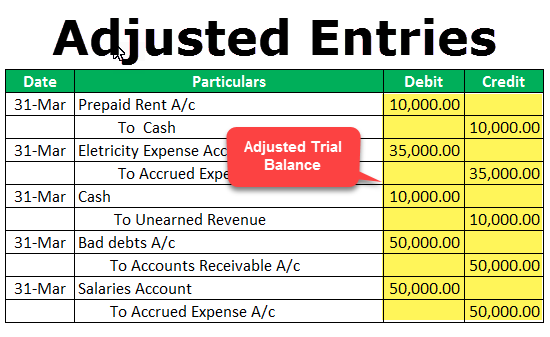

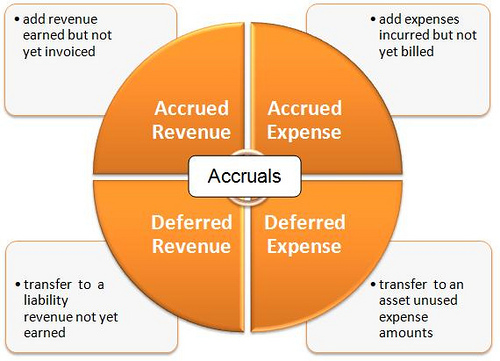

Accrued revenue is an asset, but it's not as valuable an asset as cash. Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. To record accrued revenue, the company accountant debits accrued billings and credits revenue for. Journal entry for accrued income/revenue. Thus, prepaid expenses, accrued income and income received in advance require adjustment.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

Company abc leases its building space to a tenant. Journal entry for accrued income/revenue. Let's assume company xyz is a widget consultancy that bills $100 an hour. Accrued revenue is the product of accrual accounting and the revenue recognition and matching principles. The accrued revenue is a current asset. Accrued revenue is the amount of revenue that is earned but not yet billed to the client. Accrued revenue is the revenue that the company already earned through providing goods or services to the customer, but the company has not received the payment from the customer regarding the. Accrued revenue refers to payments not yet received for goods or services already provided. The renter benefits from the rent expense all month. Examples of accrued revenue items might be services you have provided but that have not yet been billed or paid. Accrued expenses broken down | adjusting entries. Accrued revenue is revenue that is recognized but is not yet realized. Examples below show two typical accrued revenue situations.

Note, in both examples above, the revenue or expense is recorded only once, and in the correct month. Unearned revenue is money that has been received when the goods and services have not. Your company lent a supplier $100,000 on december 1. Accrued revenue is the amount of revenue that is earned but not yet billed to the client. Revenue is recognized before cash is received.

Suppose a business has a contract. Company abc leases its building space to a tenant. Unbilled revenue is an adjusting entry that is very common in service businesses. Unearned revenue is money that has been received when the goods and services have not. Accrued revenue is the amount of revenue that is earned but not yet billed to the client. Examples of unrecorded revenues may involve interest revenue and completed services or since the company accrues $50 in interest revenue during the month, an adjusting entry is made to. As we know that accounting is done on the basis of the accrual concept. The accrued revenue concept and similar ideas enable sellers and buyers to implement accrual principles accurately. Thus, prepaid expenses, accrued income and income received in advance require adjustment. Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Revenue is recognized before cash is received. In this example, rent of $2000 has been received with $400 owing. Rent is a good example.

Accrued revenue refers to payments not yet received for goods or services already provided. Accrued revenue is revenue which has been earned by a business for goods and services provided to a customer but which has not yet been invoiced to the customer. Unbilled revenue is an adjusting entry that is very common in service businesses. In this example, rent of $2000 has been received with $400 owing. Unearned revenue is money that has been received when the goods and services have not.

Examples of unrecorded revenues may involve interest revenue and completed services or since the company accrues $50 in interest revenue during the month, an adjusting entry is made to. That's because it takes the effort of billing and collecting from the customer to transform accrued revenue into cash. Accrued revenue is the product of accrual accounting and the revenue recognition and matching principles. As for your examples, you've got it down pat. The renter benefits from the rent expense all month. Accrued revenue is the revenue that the company already earned through providing goods or services to the customer, but the company has not received the payment from the customer regarding the. Journal entry for accrued income/revenue. Accrued revenue consists of income that has been earned from customers but no payment has been received. Accrued revenue is the amount of revenue that is earned but not yet billed to the client. For example, abc marketing agency signs up for a marketing automation software, 'yoohoo', that's billed quarterly at $600 for a. Company abc leases its building space to a tenant. Abc international has a consulting project with a large client, under which the consulting agreement clearly delineates two milestones. Let's assume company xyz is a widget consultancy that bills $100 an hour.

Accrued Revenue Examples: Let's assume company xyz is a widget consultancy that bills $100 an hour.

Source: Accrued Revenue Examples

0 Response to "Find Out 17+ Facts Of Accrued Revenue Examples People Forgot to Share You."

Post a Comment